Effective Ways to Avoid Interest on Credit Card Payments in 2025

Understanding Credit Card Interest Rates

Before we dive into specific tips on how to avoid interest on credit cards, it’s essential to understand the nuances of credit card interest rates. The Annual Percentage Rate (APR) dictates how much interest you’ll pay on any outstanding balance each year. Familiarizing yourself with the terms of your credit card can significantly influence your credit card balance management. For example, different cards come with various APR types: fixed or variable. A fixed APR remains the same, while a variable APR fluctuates based on market rates. Take the time to read through your card’s terms to ensure you’re aware of how interest accumulates and identify smart credit card usage tips that can help you avoid unnecessary costs.

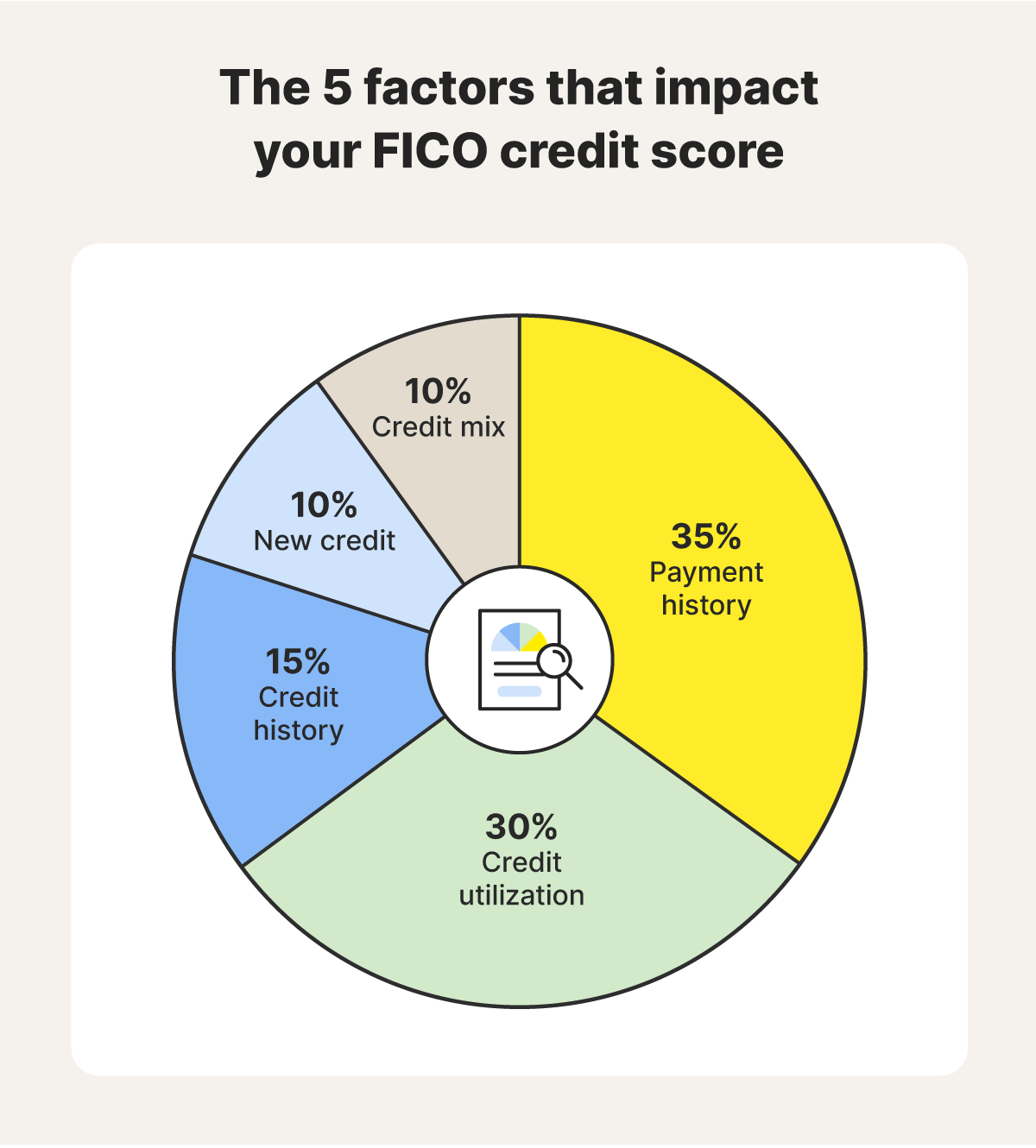

Credit Utilization Tips

One of the most effective tips for reducing credit card debt is managing your credit utilization ratio, which is the percentage of your available credit that you’re currently using. Ideally, keeping your utilization rate below 30% can positively impact your credit score, making it easier to manage your finances effectively. For instance, if you have a limit of $10,000, try to keep your outstanding balance below $3,000 to maintain a healthy credit profile and help you learn how to minimize credit card charges over time. Using your credit card responsibly in this manner can create a safety net against accruing interest, especially when making large purchases.

Using Zero Interest Credit Cards Wisely

Utilizing zero interest credit cards can be an effective strategy to avoid credit card interest altogether. These cards often come with introductory periods (sometimes up to 18 months) where you’ll pay no interest on your purchases. To maximize this opportunity, create a structured repayment plan ahead of time. For instance, if you’re given a year of zero interest and you make a $1,200 purchase, aim to pay off approximately $100 monthly to completely reduce your balance before the promotional period ends. This intentional approach teaches you effective budgeting with credit cards and keeps you clear of potential debt traps at the end of the promotional phase.

Managing Credit Card Payments Effectively

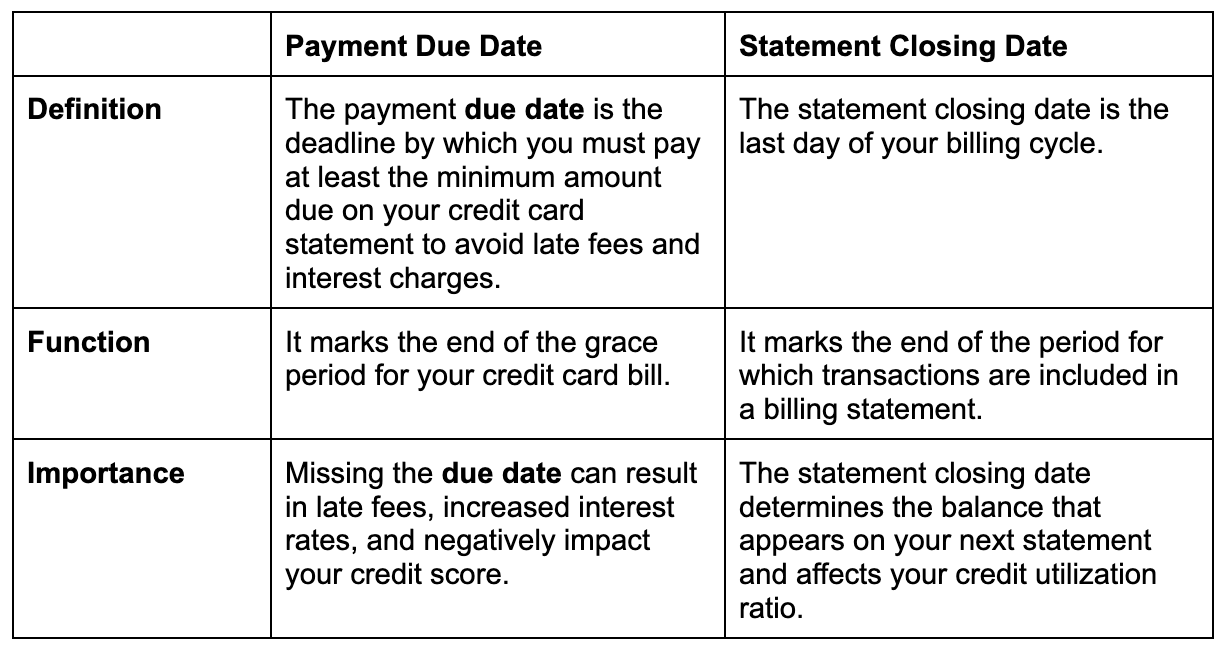

Timely management of credit card payments is fundamental in avoiding unnecessary finance charges. Research indicates that late payments can have a negative impact on your credit score, potentially leading to increased interest rates in the future. One simple yet effective tip is to set up automated payments or use payment reminders to ensure your bills are paid on time. By just avoiding one late payment, you could save yourself from the inconvenience of late payment fees, protecting your credit utilization tips and maintaining a positive financial standing.

Benefits of Paying Off Credit Cards

Paying off your credit card balances each month can lead to numerous benefits, the most significant being the avoidance of interest. This practice enhances your financial health and improves your credit score. Additionally, it demonstrates to lenders that you are capable of managing credit card payments effectively. If you can cultivate habits around preventing text phrases in finance and behavior, the resultant emotional alleviation makes for healthier financial decisions. Strategically, this leads to better relationships with creditors—keeping your credit usage assessments in check and detouring through debt’s pitfalls.

Creating a Payment Plan to Avoid Interest

To successfully fend off credit card interest, developing a systematic payment plan can be a game changer. For instance, if you have multiple credit cards, consider the snowball or avalanche method to prioritize payments. The avalanche strategy targets the highest-interest card first, potentially minimizing the amount of interest you pay in the long run. Start with the card that has the highest APR while making minimum payments on your other cards. Once you’ve eliminated the high-interest debt, move on to the next card. This focused approach not only aids in managing subscription charges and further amplifies your understanding of how to avoid interest on credit cards but also dramatically clears your remaining dues more efficiently.

Tips for Using Credit Cards Responsibly

Responsible use of credit cards is fundamental in avoiding potential pitfalls related to credit card interest accumulation. When leveraging credit for substantial purchases, always consider if you have the capacity to pay off those expenses promptly. Using credit cards for emergencies constitutes responsible borrowing, yet requires strict adherence to a budgeting technique for credit cards. Craft a typical spending and repayment plan to ensure spending limits do not propagate impulse buying, leading to unnecessary debt.

Evaluating Credit Card Offers

Before applying for a new credit card, evaluate several offers based on fees, rewards, and interest rates. For example, some cards offer rewards and cashback programs with no annual fee, while others may have a low-interest rate with high fees. This evaluation process not only assists in understanding terms and conditions but also allows you to identify high interest credit card solutions that truly fit your financial strategies without the consequences of spiraling debt.

Timing Purchases with Promotions

An effective strategy for mitigating credit card interest also involves timing your major purchases around promotional interest offers. For example, if you plan to buy a new appliance or undertake a home project, consider scheduling these purchases during a card’s promotional period with lower APR. This tactic allows you to save money and keep paying down credit card balances more effectively, thereby fulfilling your financial planning importance without hefty interest fees looming over your payment schedules.

Key Takeaways

- Understanding your credit card’s APR is vital for managing interest effectively.

- Utilizing zero interest cards can help strategically eliminate debt during the promotional periods.

- Establish dependable habits for timely payments to protect your credit status.

- Assessing offers can lead you to the most beneficial credit options for you.

- Using credit cards responsibly extends beyond avoiding interest; it improves overall financial health.

FAQ

1. What are the benefits of no interest credit cards?

No interest credit cards come with promotional offers that can help consumers manage their finances effectively. These cards allow individuals to make purchases without accumulating interest for a specific period, enabling them to pay off larger expenses more manageable and defer payments with ease. This can be advantageous when seeking to improve one’s financial health or save for future expenses.

2. How can I negotiate lower interest rates?

Negotiating lower interest rates is typically feasible with consistent credit card payments and a good credit score. Contact your credit card issuer and express your request to have your interest rate reviewed based on your repayment history. Highlight any other offers you might have received from competitors as leverage in the negotiation. If they want to keep you as a customer, they may agree to lower your rate.

3. What are the dangers of neglecting credit card bills?

Neglecting credit card bills can have significant consequences, including accumulating high interest, late fees, and a detrimental impact on your credit score. A lower credit score complicates borrowing and may impede opportunities for housing or car loans. This situation emphasizes the importance of payment due dates knowledge and maintaining timely payments in your financial management.

4. How do balance transfers work to avoid interest?

Balance transfers allow you to move high-interest debts from one credit card to another with a lower APR, sometimes even at 0%. During promotional periods, the new card provides a window in which interest is waived on transferred balances, making it an effective tool for credit card debt management. Just keep in mind to pay off the transferred amount before the promotional period ends to fully benefit.

5. How can effective budgeting prevent credit card after-use impact?

Implementing effective budgeting strategies can significantly minimize the aftermath of credit card use. By meticulously tracking expenses, setting specific spending allowances, and evaluating your cash flow, you can avoid accumulating overspending on your credit cards. This approach further enriches your understanding of fiscal responsibility and promotes healthy credit habits.