How to Properly Endorse a Check: Discover Essential Tips for Smooth Transactions

Endorsing a check correctly is crucial for ensuring smooth transactions, whether for personal or business purposes. Proper endorsement not only legitimizes the check but also prevents potential issues with cashing or depositing it. In this article, we will explore essential tips for endorsement, effective practices, and other aspects that promote seamless financial exchanges.

Understanding Endorsements

Endorsing a check involves signing the back of the check to authorize its transfer or to facilitate its cashing or deposit. This practice is commonly recognized in finance, and there are different types of endorsements, such as a blank endorsement, restrictive endorsement, and special endorsement. A **blank endorsement** allows anyone to cash or deposit the check, while a **restrictive endorsement** specifies conditions (e.g., “For deposit only”), and a **special endorsement** suggests the check can only be transferred to a specific individual or business. Ensuring your endorsement is clear can help prevent misunderstandings and fraudulent activities.

Types of Endorsements

Different types of endorsements allow for various scenarios in check transactions. The **blank endorsement** is the most common method, simply requiring a signature. However, this endorsement lacks restrictions and may expose you to theft. The **restrictive endorsement** offers extra security by limiting how the check can be used. Phrasing it as “For deposit only” followed by your account number ensures safety and promotes proper handling. The **special endorsement**, such as “Pay to the order of [name],” directs the check to a specified party. Understanding which endorsement to use promotes clarity in financial dealings.

How to Endorse a Check Safely

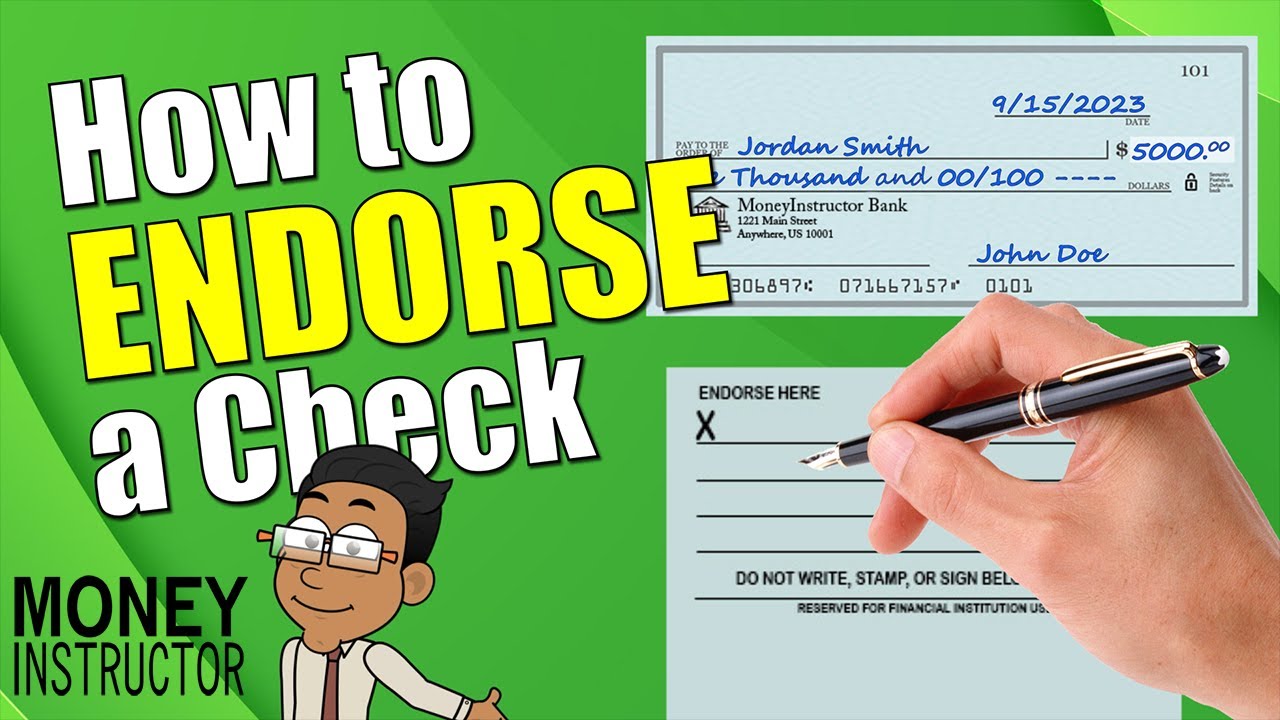

To successfully endorse a check, follow a few straightforward steps. First, flip the check over to the designated endorsement area, which is typically located at the top. Then, clearly sign your name as it appears on the front of the check. Depending on your needs, you can also make use of a restrictive or special endorsement. For instance, when endorsing a check for deposit into your bank account, write “For deposit only” followed by your signature and account number to enhance security. This simple act shows confidence and invites accountability, ultimately streamlining the endorsement process.

Common Mistakes in Check Endorsement

Missteps happen in check endorsements that can result in unwanted delays or rejections during transactions. One common mistake involves incomplete endorsements; failing to include necessary details like your signature or restrictive instructions can cause issues. Another mistake is placing an endorsement too close to the edges of the check, potentially rendering it unusable. Always ensure that your endorsement remains within the designated area and adequately includes all relevant details. By avoiding these pitfalls, you lend credibility to your transactions and uphold high standards in financial dealings.

Benefits of Proper Endorsement

Adequately endorsing a check offers numerous benefits. It not only confirms your authority to manage the funds but also safeguards against unauthorized access or disputes. Additionally, proper endorsement builds trust with banks and financial institutions, as they can verify authenticity with confidence. For businesses, sound endorsement practices, such as presenting corporate checks with appropriate authorization, foster positive relationships and enhance credibility in transactions. Following best practices also encourages customer satisfaction and reinforces an organization’s reputation, thereby stimulating future opportunities.

Building Trust with Proper Check Endorsement

Trust is critical when handling financial transactions. Endorsing checks correctly signals professionalism to banks and clients alike. Financial institutions typically treat transactions with customarily made endorsements more seriously than those that appear careless or unprofessional. A simple signature can reflect an advocate’s commitment to security, promoting confidence among all parties involved. By fostering trust, organizations can improve their reputation and create a reliable environment for both endorsements and business operations.

Regulatory Considerations for Endorsements

Being aware of regulatory measures surrounding check endorsements can help further safeguard funds and streamline transactions. Legal regulations dictate that certain checks require explicit instructions when transferring funds. Endorsements must satisfy these guidelines to uphold the legality of transactions. Failing to comply may invite disputes or the invalidation of endorsements across various financial platforms. Organizations should stay informed of the latest regulatory measures, ensuring practices align with industry requirements. Upholding such standards champions superior financial stewardship and reinforces dignity in operations.

Avoiding Fraud with Effective Endorsements

Theft and check fraud are unfortunate realities that can derail financial transactions. Effective endorsements promote safety and mitigate risks associated with these threats. Keep checks secure and endorse them as close as possible to the time of signing. Avoid leaving checks unendorsed in visible areas to discourage opportunistic fraud. You can also employ best practices, such as notifying clients about upcoming endorsements or choosing only reputable vendors. These strategies empower individuals and businesses to **stand by** users’ interests, strengthening access to funds while eliminating exposure to fraudulent activity.

Practical Tips for Endorsement

To endorse a check effectively, consider using these practical tips: Utilize clear and precise language when executing your endorsement to reduce ambiguity and misunderstandings. Always double-check that your Signature matches your name as printed on the front. Keep your endorsement safe and secure by locking checks in a drawer until you’re ready to endorse them. Moreover, if you’re unsure of endorsement procedures or need assistance, don’t hesitate to seek counsel from a bank representative. Showing faith in expert guidance enhances a fluid transactional environment that champions transparency and adherence to established practices.

Step-by-Step Check Endorsement Guide

Follow this straightforward step-by-step guide for successfully endorsing a check: First, securely hold the check to prevent damage. Flip it over and locate the designated endorsement section. Next, prepare for your endorsement—write your signature confidently, ensuring alignment with the front of the check. If desired, include a restrictive or special endorsement for added security. Finally, review your endorsement for clarity before physically submitting it for cashing or depositing. The careful nature of this process affirms your commitment to steady financial transactions.

Learn from Case Studies

Reviewing successful endorsements through the lens of case studies can reveal valuable insights. For instance, a community incorporation mechanism adopted clear endorsement guidelines to maintain public trust and secure effective partnerships across municipal projects. By establishing tiny foundations on proper endorsement practices, stakeholder confidence grew, thus instilling dependency to uphold high community standards and accountability. Learning from such case studies underscores the importance of professionally navigating endorsements by highlighting **trust signals** prevailing in best practices and prudent policy adoption.

Key Takeaways

- Properly endorsing checks is essential in facilitating smooth financial transactions.

- Different types of endorsements cater to varying needs; understand when to use each.

- Endorsements should maintain clarity and precision to avoid misunderstandings.

- Prioritize security and trust in endorsements to protect against fraud.

- Utilize simple steps and case studies to reinforce effective endorsement practices.

FAQ

1. What is a blank endorsement, and when should it be used?

A **blank endorsement** is where the check signer simply writes their signature on the back of the check. It’s typically used for straightforward cashing or depositing of checks; however, it does not protect against theft as anyone holding the endorsed check may cash it. Use it primarily for checks you intend to deposit immediately.

2. How does a restrictive endorsement differ from other endorsements?

A **restrictive endorsement** specifies conditions; for example, writing “For deposit only” limits what can be done with the check. This safeguard enhances security and ensures the check is credited directly to your account, preventing unauthorized access. It’s particularly useful when you’re concerned about misplacement or fraud.

3. Can I endorse a check over to someone else?

Yes, a specific kind of endorsement called a **special endorsement** allows you to endorse a check over to another person. By including “Pay to the order of [recipient’s name]” beneath your signature, you can effectively transfer ownership of that check with appropriate authorization, legitimizing the transaction provided it adheres to your financial institution’s regulations.

4. What happens if I make a mistake in my endorsement?

If a mistake is made during endorsement, the check may be rejected by the bank. Clearly marking through the erroneous information and initialing the change may resolve the issue. However, it’s best practice to request a new check if you cannot correct it accurately. Working directly with the issuer ensures a smooth reissue process.

5. How can I prevent check fraud during endorsements?

To thwart check fraud, ensure checks are handled securely and endorse them immediately prior to cashing or depositing. Use restrictive endorsements whenever possible and maintain vigilance over check transactions—timely awareness acts as a deterrent against fraud. Being proactive reinforces organizational ownership and inspires transforming stakeholder confidence.

6. What should I do if a check bounces after endorsement?

Should a check bounce after endorsement, contact the issuer to resolve the issue. A bounced check can disrupt financial stability, so working with the issuer for clarification is vital. Summarizing the underlying cause may also assist in assuring awareness of the endorsement process leading up to the bounce.