How to Properly Endorse a Check: Essential Tips for 2025

Understanding how to endorse a check is vital in today’s banking environment. Whether it’s for personal use or business transactions, the way you endorse a check can affect its processing and security. This guide will walk you through the essential steps and best practices for , focusing on everything from third-party check endorsements to the legalities involved in the check endorsement process. By following these comprehensive instructions, you can confidently navigate your check transactions.

Understanding Check Endorsements

Checks play a crucial role in financial transactions, making it essential to understand the endorsement on checks. An endorsement is simply the act of signing your name on the back of a check, which authorizes the transfer of funds. This section will cover various check endorsement types, helping you to determine which method suits your needs best. Properly endorsing a check protects both the payer and the payee and ensures that funds are transferred securely and correctly.

Types of Check Endorsements

There are several check endorsement types that you can choose from, each serving a specific purpose. The most common types include:

- Blank Endorsement: A simple signature on the back allows anyone to cash or deposit the check.

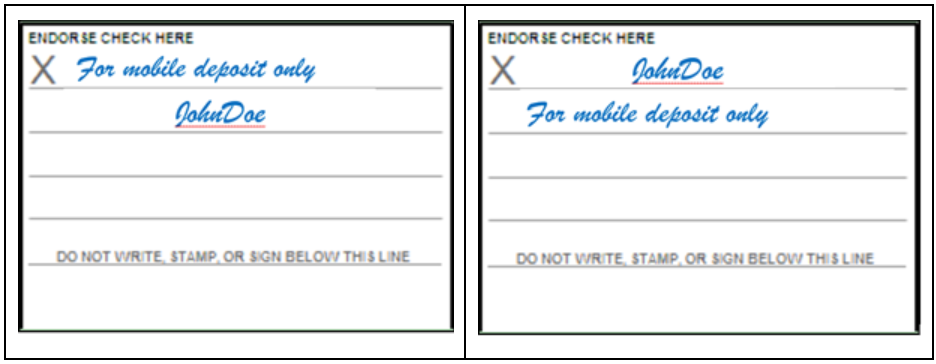

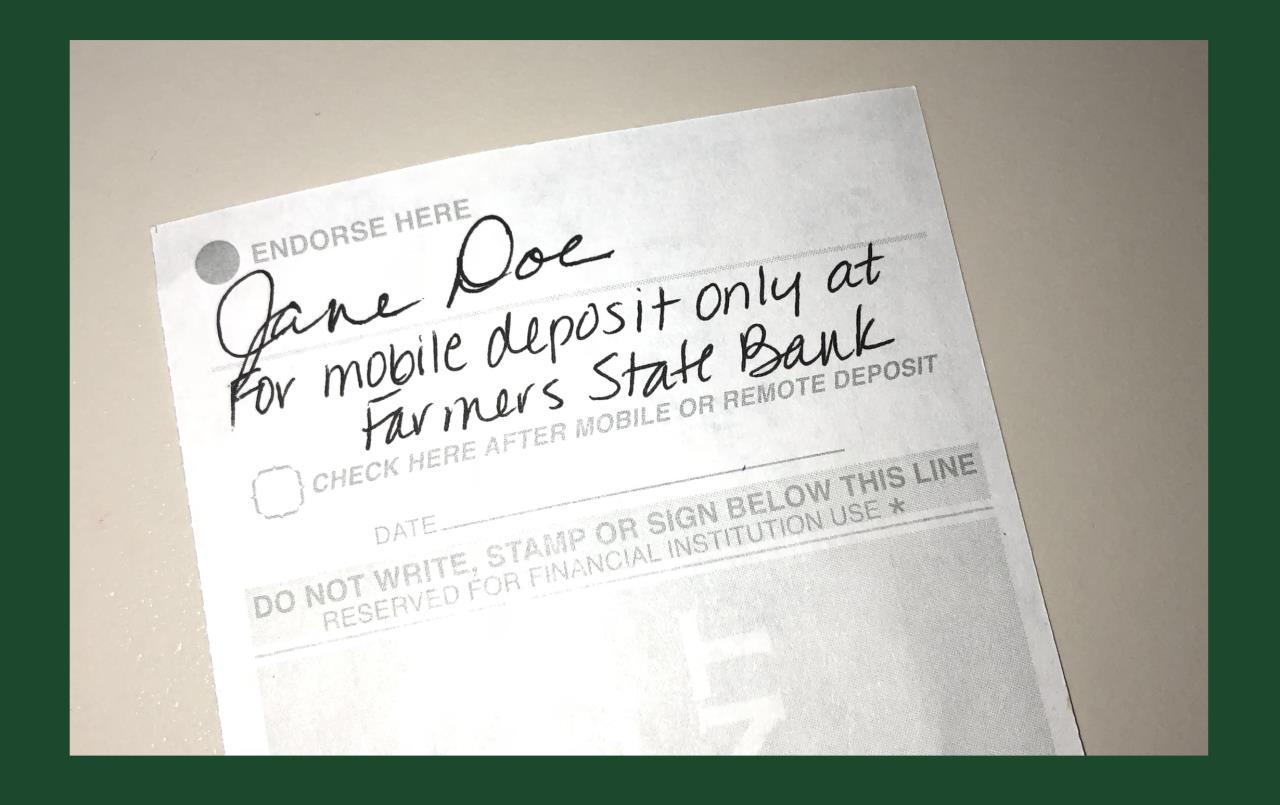

- Restrictive Endorsement: Includes “For Deposit Only,” which limits how the check can be used—ideal for ensuring funds are only deposited into a specific account.

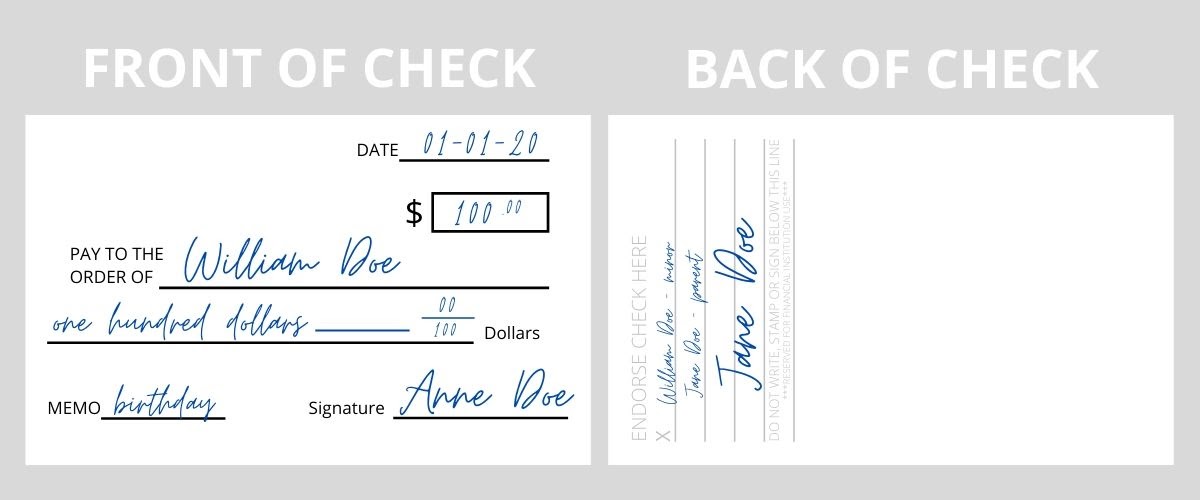

- Third-Party Endorsement: Allows someone else to cash or deposit the check. This requires signing the check and potentially adding additional identifying information.

Choosing the correct endorsement type is vital for ensuring the right transaction occurs. If you plan to endorse a check to someone else, be mindful of the bank’s policies on third-party check endorsement legality.

Steps to Endorse a Check

The check endorsement process can be simplified by following a few clear steps:

- Locate the endorsement section on the back of the check — this is usually a blank area designated for signatures.

- Choose your endorsement method based on what you want to do with the check (e.g., cash, deposit, or transfer to a third party).

- Sign your name as it appears on the front of the check to authenticate your endorsement.

- If applicable, include any additional instructions (like “For Deposit Only”) to limit how the check can be used.

By adhering to these steps, you can ensure that your checks are endorsed correctly and without complications.

Common Check Endorsement Mistakes

Even seasoned individuals can encounter issues when endorsing checks. Avoiding popular check endorsement mistakes will help you navigate any potential pitfalls:

- Not signing the check as it is written on the front can lead to endorsement failure scenarios.

- Overlooking specific bank policies regarding endorsements on checks can result in additional hassle.

- Not using the correct endorsement type when transferring a check to someone can complicate the process.

- Forgetting to indicate any limitations on how the check may be handled can leave you susceptible to fraud.

Endorsing Checks for Different Scenarios

Depending on your financial needs, you may encounter many scenarios necessitating different endorsement approaches. Below are some common instances where understanding specific endorse check guidelines is crucial.

Endorsing a Personal Check

When you need to endorse a personal check, simply sign on the back, ensuring your signature matches the printed name on the front. This is usually straightforward; however, if you are making a deposit into a joint account or transferring the check, you may need to include both names on the endorsement.

Endorsing a Government Check

Government checks often have stringent guidelines for check endorsement. Ensure that you adhere to these rules; simple endorsements work well, but if you’re making a deposit on behalf of someone else, you may have to provide identification or specific bank documentation to process your transaction effectively.

Endorsing Checks for Business

If you’re endorsing a check to a business, include the business name and your title. Notching this vital detail clarifies the transaction’s purpose. In situations where digital checks are involved, be mindful of how online check endorsement works, as you may be required to upload scans and verify each step of your endorsement.

Follow the Rules: Check Endorsement Laws and Policies

It is essential to be aware of the endorse check rules and the legalities surrounding them. Different banks may have varying policies, so it’s important to familiarize yourself with them to ensure smooth transactions. In this section, we’ll explore some of the crucial aspects you need to be aware of.

Bank Policies on Check Endorsements

Every financial institution has its policies about endorsement verification, and many will require specific formats or information. Always consult your bank’s policies before sealing the deal, and don’t hesitate to ask bank representatives for clarification on their endorsement requirements.

Legal Implications of Endorsing a Check

Making a mistake while endorsing a check can result in television-worthy escapades. Knowing your endorse check requirements and check endorsement regulations can save you from unnecessary trouble. For instance, misusing a restrictively endorsed check could lead to accusations of fraud. It is essential to adhere to legal standards to avoid complications.

Risks when Endorsing Checks

While checks have been a mainstream way to transact for years, risks still abound. Be cautious about how you endorse checks, particularly if you are handling checks for others. Events such as theft, check fraud scams, or simple human error can jeopardize your financial transactions. Ensuring secure check endorsements can prevent fraud and protect your finances.

Key Takeaways

In summary, knowing how to endorse a check correctly is essential for ensuring successful financial transactions. Remember these key points:

- Ensuring proper endorsement can make a difference in both personal and business transactions.

- Each situation requires understanding the appropriate check endorsement method.

- Be aware of your bank’s policies and legal requirements to ensure smooth processing.

FAQ

1. Who can endorse a check?

Generally, the person or entity to whom the check is made out can endorse it. Additionally, third parties may also endorse the check if proper instructions are followed. Understanding the requirements can ensure effective transactions.

2. Can I endorse a check without a signature?

Endorsing a check without a signature is typically not accepted, as a signature serves as proof of identity and authorization. Always sign as indicated; failure to do so can result in check dishonor.

3. What happens if I endorse a check incorrectly?

Incorrect endorsements can lead to transaction failures, causing frustration and potential delays. It’s vital to double-check that all necessary details are accurate and that your signature aligns properly with what is written on the check’s front.

4. Can an endorsed check be deposited online?

Yes, many banks offer mobile check endorsement services where you can deposit checks digitally. Be sure to follow guidelines clearly; for a deposit to process, the endorsement must be correct.

5. Are there limitations on third-party check endorsements?

Yes, many banks have strict guidelines regarding third-party check endorsement legality. Always consult with your bank to know specific requirements and potential restrictions to avoid complications.

By adhering to the guidelines and tips provided, you can ensure that your checks are endorsed correctly, making financial transactions more secure and straightforward in 2025.