How to Set Up Apple Pay for Your Business

Setting up Apple Pay requires careful planning and execution, especially for small businesses aiming for a seamless transition. Understanding the *setup requirements* and choosing the right payment gateway are critical steps in this process. This section delves into the *Apple Pay setup requirements*, highlights the importance of *setting up an Apple Pay account*, and provides actionable steps for *enabling Apple Pay in-store and online*.

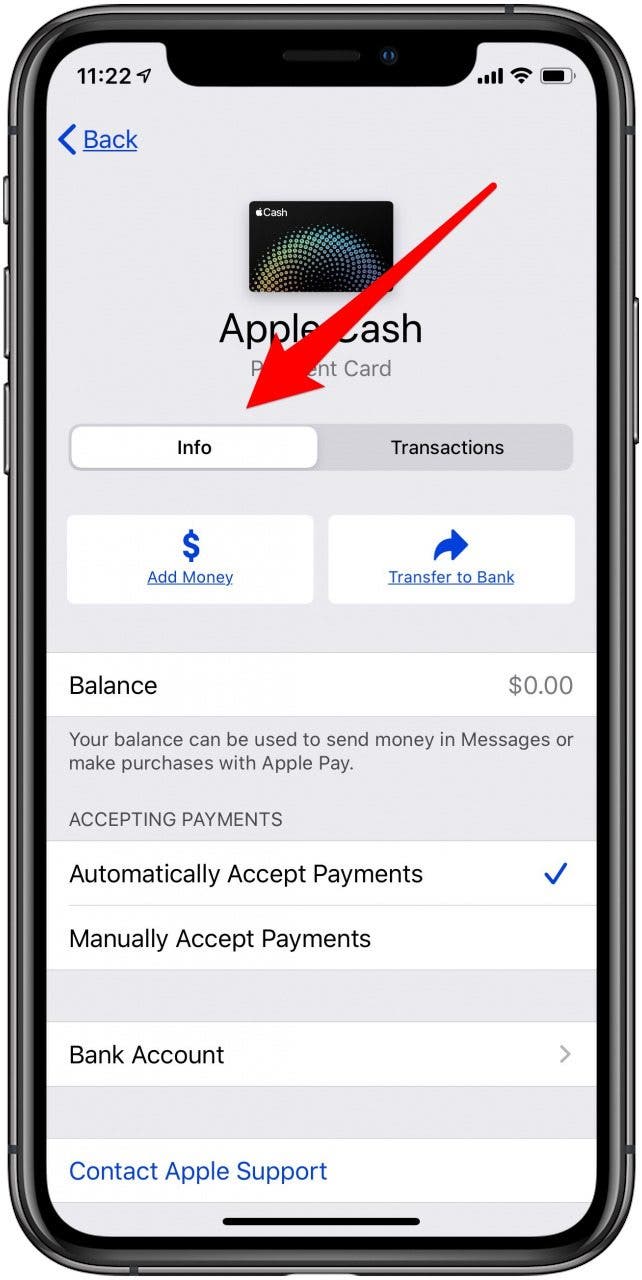

Apple Pay Setup Requirements

Before you can *accept Apple Pay*, you need to ensure you meet the prerequisites. First, you must have a compatible Apple Pay Merchant Account, which allows you to process payments via the Apple ecosystem. You also need to integrate with a payment processor that supports Apple Pay transactions, which often comes with *setup fees for Apple Pay*. Familiarizing yourself with these requirements and understanding them will facilitate quicker onboarding and ensure your business is ready to leverage Apple Pay efficiently.

Steps to Enable Apple Pay in Your Store

To enable Apple Pay in-store, you should ensure you have **payment terminals** that support NFC technology. Start by checking with your payment processor to confirm compatibility with Apple Pay. Once confirmed, you should configure your payment terminal with *Apple Pay integration* by following manufacturer guidelines. Conducting successful trials is essential—conduct *Apple Pay trials* especially during peak hours to ensure reliability and familiarity before launch. This planning establishes a strong foundation for efficient transactions in your retail space.

Integrating Apple Pay on Your Website

If you operate an e-commerce platform or a website that accepts payments, integrating Apple Pay is crucial for optimizing the user experience. Begin by choosing a reliable payment gateway that supports *Apple Pay for websites*. Afterward, implement the provided SDKs (Software Development Kits) to your existing checkout system. Don’t forget to customize and test the *Apple Pay checkout process*, ensuring that the button prominently features on your website. This kind of thoughtful integration is vital to maintain a slick shopping experience for users, which can dramatically increase *sales with Apple Pay*.

Best Practices for Accepting Apple Pay

Adhering to best practices when integrating Apple Pay can significantly enhance your payment efficiency and customer satisfaction. From robust security measures to marketing strategies, being informed can help propel your business forward. This section outlines the *best practices for Apple Pay*, discusses *customer support for Apple Pay*, and describes how to handle refunds effectively.

Apple Pay Integration Best Practices

When integrating Apple Pay, focus on optimizing the payment experience for users. Start by prominently displaying the Apple Pay option during checkout to attract users familiar with the service. Moreover, ensure that you have the latest updates from your payment processor regarding *how to configure Apple Pay* effectively. Regularly reviewing *Apple Pay reports and analytics* can also provide insights into transaction performance, offering opportunities for further improvements in your payment process, which can keep you competitive in a fast-evolving market.

Handling Refunds with Apple Pay

Understanding *how to handle refunds with Apple Pay* is as essential as the payment process itself. Apple Pay maintains a user-friendly process for issuing refunds, making it important for merchants to train staff adequately. Refunds can be processed through your payment terminal or online payment system, with transaction records being updated seamlessly. Departments should stay well-informed about *apple pay transaction notifications*, as timely notifications of successful refunds enhance customer trust and satisfaction significantly.

Customer Support for Apple Pay

In any payment system, having a dedicated customer support channel is crucial. Merchants should prioritize *customer support channels for Apple Pay* that can assist with inquiries related to transactions, technical issues, or disputes. Staff training is imperative—not only should employees be knowledgeable regarding *how to use Apple Pay*, but they should also be prepared to troubleshoot common *Apple Pay acceptance* issues. This preparation ensures that customers feel supported throughout their payment experience.

Optimizing Your Apple Pay Acceptance Process

As consumer habits evolve, finding ways to optimize how you accept Apple Pay is paramount for driving transaction volumes and improving customer satisfaction. This section explores *optimizing the Apple Pay process*, *testing Apple Pay functionality*, and leveraging data analytics for improved payment acceptance.

Testing Apple Pay Functionality

Before rolling out Apple Pay for all transactions, performing thorough testing is essential. Conduct various test transactions in real-time to gauge the speed and reliability of your setup. Focus on **transaction limits** and *payment flow*, ensuring that customers face no barriers during their purchase experience. Utilizing both varying payment amounts and device types can provide a comprehensive overview of your setup’s efficiency and reliability. Test results can offer critical insights into potential updates and changes to enhance the process further.

Analytics and Reporting for Continuous Improvement

Utilizing **Apple Pay reports and analytics** effectively can drive optimization. Tracking transaction success rates, customer behavior, and peak payment times through analytics will reveal trends and insights crucial for refining your approach. For example, you may find higher adoption rates during specific promotions. Leverage this data to fine-tune marketing strategies, promotions, and customer engagement practices. Regularly reviewing *payment processing compliance* features, and updating settings accordingly will maintain your readiness against fraud and regulatory changes while aiming to enhance the overall customer payment experience.

Leveraging Marketing Opportunities

Consider launching promotions that specifically cater to customers who use Apple Pay, showcasing the seamless payment experience. Collaborate with Apple to incorporate campaign materials and *Apple Pay incentives for merchants* that can highlight your commitment to customer-friendly payment solutions. This visibility can boost not only customer engagement but also sales volume, enhancing your business reputation as forward-thinking and customer-focused.

Key Takeaways

- Understanding the setup and functionality of Apple Pay is crucial for small businesses vying to enhance payment options.

- Business owners must adhere to best practices to safeguard transactions and optimize the Apple Pay acceptance process.

- Testing and utilizing analytics will drive improvements in customer experience and payment efficiency.

- Communicating with your customers about Apple Pay can enhance adoption and ensure better service.

FAQ

1. What types of businesses can benefit from accepting Apple Pay?

Almost any small business can reap the benefits of accepting Apple Pay, particularly in retail, e-commerce, restaurants, and service industries. The ability to process *contactless payments* quickly appeals to consumers who seek convenience and speed in transactions.

2. Are there fees associated with accepting Apple Pay?

While there typically aren’t additional fees solely for using Apple Pay, merchants may incur standard processing fees through their payment processors. It’s essential to compare different *payment options* and select the one that suits your business needs effectively.

3. How can I educate my staff on Apple Pay acceptance?

Training is crucial; provide staff with clear guides and real-life scenarios during simulated transactions. This can build their confidence as they assist customers and can lead to a smoother transactional experience for everyone involved.

4. What if a customer experiences issues when using Apple Pay?

Stay proactive by ensuring your customer support team is well-trained in common **Apple Pay** issues. Being ready to troubleshoot will provide a great *customer experience* and address concerns promptly, aiding in customer retention.

5. Can nonprofits also accept Apple Pay?

Absolutely! Nonprofits can benefit from accepting Apple Pay via donation pages on websites or during fundraising events. It can increase the ease and speed of donation processes, leading to potentially higher contributions.