“`html

Essential Guide to How to Use Robinhood Effectively in 2025

Robinhood has revolutionized the trading landscape, providing users with an accessible platform for investing without the burden of commission fees. In this essential guide, we’ll explore how to effectively utilize the **Robinhood app**, highlighting key features, investment strategies, and tips for both beginners and experienced traders. Whether you’re focused on **buying stocks on Robinhood** or interested in **trading options** and cryptocurrencies, this guide will cover everything you need to thrive in 2025.

Getting Started with Robinhood

To begin your investment journey, understanding the process of creating and funding your Robinhood account is paramount. First, you must **create a Robinhood account**, which is a straightforward process. The app requires some personal information and identification for security purposes and to comply with financial regulations. Once you have your account set up, you will need to learn about the various ways to **deposit money in Robinhood** , which can typically be done through linked bank accounts.

Setting Up Your Robinhood Account

When you decide to **create a Robinhood account**, ensure that you have your identification documents handy as they may require verification. After your account is established, you can link it to your bank account which enables you to easily **deposit money in Robinhood** for trading purposes. Simply navigate to the account section, select “Transfer,” and follow the prompts to fund your account. Robinhood also allows instant deposits, meaning you can start trading quickly even before your transfer has cleared, making it convenient for timely trades.

Understanding Robinhood Features Explained

It’s essential to familiarize yourself with various **Robinhood features** that enhance your trading experience. For example, you can explore the educational resources provided through the app, which are designed to help you improve your trading knowledge and skills. Features like **robinhood commission-free trading** mean you can make as many trades as you’d like without worrying about extra fees. Moreover, use the **robinhood research tools** and **robinhood stock options** to analyze options for smarter investment choices.

Investing Strategies on the Robinhood App

Robinhood empowers users to explore various investing strategies, making it easier to align trades with individual financial goals. For those engaging in **investing in stocks with Robinhood**, understanding market trends and their implication on stock prices is critical. Employing a solid strategy can significantly affect your growth in the stock market, especially in volatile times.

Strategies for Beginners on Robinhood

For beginners, one of the most important strategies is to start with a **robinhood investment strategy** that showcases your risk tolerance and investment goals. Consider investing in **ETFs** (Exchange-Traded Funds) or fractional shares of large companies, which are versatile and suit different risk profiles. This approach allows you to build a diversified portfolio gradually while understanding the dynamics of several stocks without committing too much capital upfront.

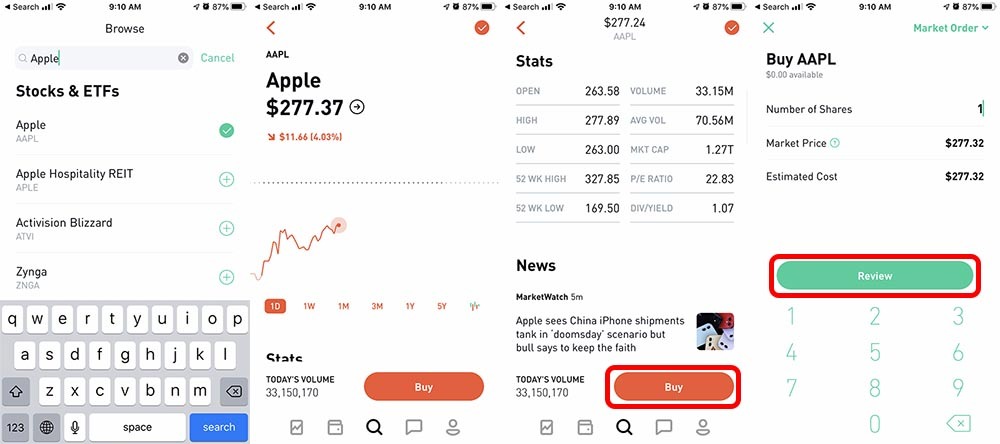

Using Robinhood for Day Trading

If you’re interested in **using Robinhood for day trading**, keep in mind that this requires a dedicated approach and a clear understanding of market conditions. The **Understand market orders on Robinhood** feature is crucial as it allows you to select the types of orders depending on your trading strategy, such as **buying stocks on Robinhood** during price dips. Utilize the **robinhood insights and news** section to keep updated with market shifts that may influence your trading decisions.

Managing Your Portfolio and Investments

Once you’ve delved into trading, understanding how to effectively manage your portfolio with Robinhood becomes critical. You have tools to **track investments on Robinhood** and analyze your profitability continually. Being proactive in monitoring your investments will help you make necessary adjustments based on market conditions and your emotional responses to gains or losses.

Customizing Robinhood Settings for Efficiency

One of the key aspects of efficiently using the Robinhood app is **customizing Robinhood settings**. This can include setting up **alerts on Robinhood** for price changes, earnings reports, and trend notifications, which will keep you informed without needing to check the app constantly. The more tailored your notifications and settings are to your trading strategies, the better chance you have of maximizing gains.

Utilizing Robinhood’s Cash Management Account

**Using Robinhood’s cash management account** is beneficial for those wanting to grow their liquidity. This feature enables you to earn interest on uninvested cash in your account while still having instant access when you need it. This is particularly useful when you aim to capitalize quickly on stock opportunities without losing out on potential earnings.

Advanced Features and Tools for Experienced Traders

For seasoned traders, Robinhood offers a variety of advanced tools such as **understanding Robinhood margin trading** and the flexibility of trading riskier assets. Familiarizing yourself with these advanced features will give you a competitive edge when executing trades and managing your portfolio’s performance.

Understanding Robinhood Fees and Their Impact

Even though Robinhood is known for its **commission-free trading**, understanding the potential **robinhood fees** is essential to minimize costs in your investment strategy. The marketplace protocols have associated costs which may affect your overall profitability, especially if trades often experience slippage during times of high volatility.

Protecting Your Robinhood Account

A key aspect of **protecting your Robinhood account** is enabling two-faentication and regularly updating your password. Safeguarding your account against potential breaches should be a top priority, considering the amount of financial data it handles. Additionally, remain vigilant about phishing attempts and use robust security practices while managing your investments.

Key Takeaways

- Start with a solid strategy that aligns with your financial goals.

- Use Robinhood’s features like research tools and commission-free trading to your advantage.

- Regularly monitor and customize your portfolio settings for optimal performance.

- Stay informed about market trends and potential risks to safeguard your investments.

- Use available advanced tools if familiar, but ensure to grasp the associated risks.

FAQ

1. What are the best tips for successful trading on Robinhood?

To engage successfully in trading on Robinhood, start by establishing clear financial goals. Use the app’s advanced tools such as **stock analysis** features. Additionally, be disciplined about your trading strategy and avoid emotional decisions. Always keep an eye on market trends and utilize **robinhood insights and news** for informed trading decisions.

2. How can I withdraw funds from Robinhood?

To **withdraw funds from Robinhood**, navigate to the account section and select “Transfer” followed by the **Withdraw** option. It’s essential to ensure that the bank account you wish to withdraw to is verified. Withdrawals may take a few business days to process, so plan accordingly to access your funds promptly.

3. Can I use Robinhood for cryptocurrency trading?

Yes, you can **use Robinhood for cryptocurrency trading**, offering several popular cryptocurrencies like Bitcoin and Ethereum. It’s beneficial to understand that trading regulations for cryptocurrencies differ from stocks. Familiarize yourself with the features available for crypto trading within the app, and monitor prices closely for strategic entry and exit points.

4. How do I analyze stocks using the Robinhood app?

To **analyze stocks on the Robinhood app**, utilize its built-in stock research tools which provide insights on historical performance, analysts’ ratings, and news related to stocks. You can also track your investments and compare them with market trends to make more informed decisions.

5. What are common pitfalls to avoid on Robinhood?

Common pitfalls on Robinhood include over-trading, disregarding investment fundamentals, and failing to set profit-taking and loss-cutting strategies. It’s also important to avoid making impulsive decisions based on short-lived market fluctuations. A solid understanding of your risk tolerance will help in mitigating these issues.

“`